Keywords

Linear Programming Problem, Data Envelopment Analysis, Multivariate Regression

Analysis, Indian Banking.

Introduction

Indian banking sector is one of the

largest banking system in the world. Indian

banking system is mainly divided into

Public Sector Banks and Private Sector Banks. The Public Sector Banks are further

divided into two categories as Nationalised

Banks and SBI group banks and Private

Sector Banks are divided into Foreign Banks and Domestic Private Banks. The

Nationalised Banks in India play the pivotal

role of Indian economy. The major market

has been captured through Nationalised

Banks. Our research has major focus on to

improve efficiencies and effectives of

Nationalised Banks of India. The purpose of

this paper is to propose a hybrid

methodology based on Data Envelopment

Analysis (DEA) and Statistical Regression

analysis that addresses to this issue of

efficiency using data from Nationalised

Indian banks.

Over the past two decades, data

envelopment analysis (DEA) has become a

popular methodology for evaluating the

relative efficiencies of decision making units

(DMUs), many researches has been

chosenbanks are decision making units.

They have proved the different DEA models

are useful for efficiency measurement of

banks andits target setting. Data

Envelopment Analysis is an approach to

estimate the production function of

organizations and organizational units and

enables the assessment of their efficiency.

The comparison of empirical results

produced by DEA and Multivariate

Regression Analysis is still uncommon in

bank efficiency literature. Multivariate

Regression Analysis is useful tool to predict

the independent value of variable from one

and more than one dependent variable.

Regression analysis is a statistical tool that

is used to investigate the relationship

between variables. It is a parametric

technique that requires the specification of a

production function.

DEA provides an estimation of the

production function to which each

individual Decision Making Unit’s (DMU’s)

efficiency score can be compared.

Furthermore, DEA offers a number of

advantages over traditional techniques

including its ability to identify reference

units for each DMU. These characteristics prove to be a very useful managerial tool as

it aids in establishing potential causes and

methods of improvement for the identified

inefficient.

Literature review

Data Envelopment Analysis (DEA)

is a linear programming technique to assess

the efficiencies of decision making units

(DMU) when multiple variables are taken

into account. Literature related to efficiency

studies can be traced back to Farrell [4], who

treated the production frontier as the basis

for efficiency assessment. The Charnes,

Cooper and Rhodes (CCR)1described a

mathematical programming formulation for

the empirical evaluation of relative

efficiency of a Decision Making Unit

(DMU) on the basis of the observed

quantities of inputs and outputs for a group

of similar referent DMUs. The Banker,

Charnes and Cooper (BCC) [6] provideda

formal link between DEA and estimation

ofefficient production frontiers via

constructs employedin production

economics. Satye [10] used DEA to study the

relative efficiency of Indian banks in the late

1990’s with that of banks operating in other

countries. He found that the public sector

banks have a higher mean efficiency score

as compared to the private sector banks in

India, but found mixed results when

comparing public sector banks and foreign

commercial banks in India. Kumbhakar and

Sarkar [11] estimated the cost efficiency of

public and private sector banks in India by

using the stochastic cost frontier model with

specification of translog cost function.

The Seiford and Zhu [8] examined the

performance of the top 55 US banks using a

two-stage DEA approach. Results indicated

that relatively large banks exhibit better

performance on profitability, whereas

smaller banks tend to perform better with

respect to marketability. Drake and

Howcroft [12] assessed the relative efficiency of UK clearing bank branches using DEA

method. This paper utilized the basic

efficiency indices and extended the analysis

by examining the relationship between size

and efficiency. Many of these studies find

that state-owned banks are more efficient

than private and foreign banks

(Bhattacharyya and Pal [19]; Sharma [20]), find

that foreign banks are actually the most

efficient. R. Kiani Mavi [17] estimated the

ranking of banks branches using DEA and

multivariate regression analysis, results

indicate that the efficiency calculated from

CCR model and multivariate regression

model has positively correlated.

Premachandra [21] examine the capability of

DEA in assessing corporate bankruptcy by

comparing it with logistic regression

(LR).The main objective of this paper to

assesses efficiency of Indian banks using

DEA technique and Multivariate Regression

Analysis techniques.

Material and Methods

Data Envelopment Analysis

Data has been collected from RBI

website for evaluation. Data Envelopment

Analysis is a linear programming procedure

for a frontier analysis of inputs and outputs.

The input-oriented DEA model under the

assumption of constant return to scale

&variable return to scale can be used for

calculation of input-oriented technical

efficiency. In this study, we estimate the

CCR model proposed by Charnes et al.

(1978) and BCC model proposed by Banker

et al. (1984), which allows for variable

returns to scale. The input-oriented CRS

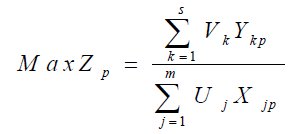

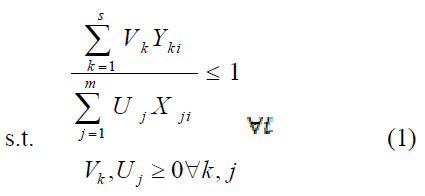

&VRS model can be written as:

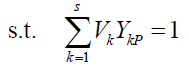

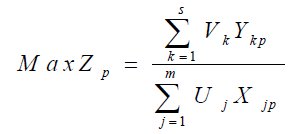

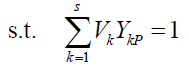

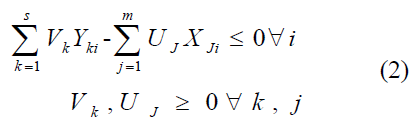

The basic input-oriented CRS model

for ‘n’ DMUs with ‘m’ inputs and ‘s’

outputs proposed by CCR, the relative

efficiency score of pth DMUs is given by

Where, k = 1 to s (number of outputs);

j = 1 to m (number of inputs);

i = 1 to n (number of DMUs);

Yki = amount of output k produced by DMU i;

Xji = amount of input j utilized by

DMU i;

Vk = weight given to output k and Uj = weight given to input j.

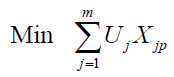

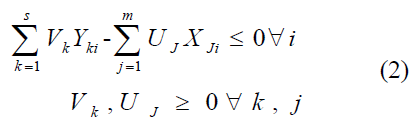

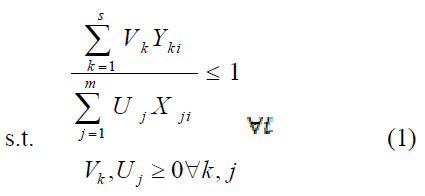

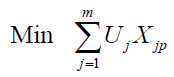

The fractional programme shown in

Equation (1) can be reduced to LPP as

follows:

This model is called CCR inputoriented

DEA model. The efficiency score

of ‘n’ DMUs is obtained by running the

above LPP ‘n’ times.

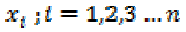

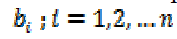

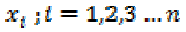

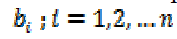

Multivariate Regression Analysis

The Multivariate linear regression

model can be return in below form

Where Y is the dependent variable

and  is the ith independent

variable. Therefore

is the ith independent

variable. Therefore  is the

coefficient of

is the

coefficient of  a is constant and

a is constant and is the

estimation error term.

is the

estimation error term.

Results and Discussion

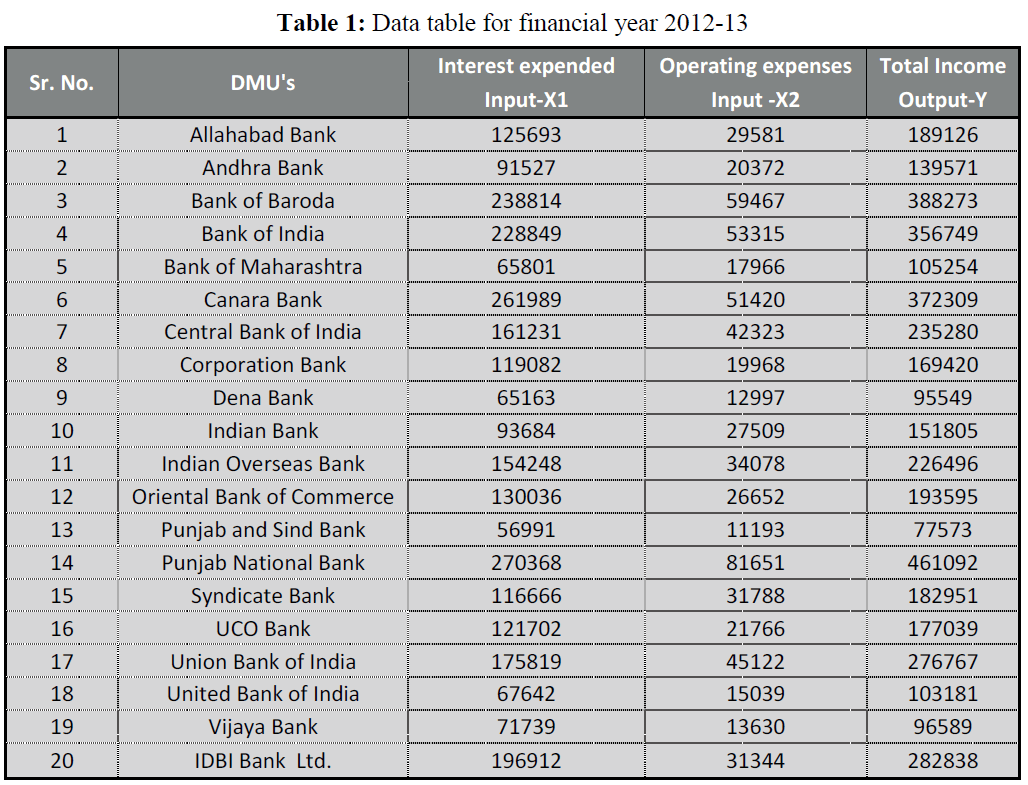

In this paper, we have analyzed

efficiency of Indian Banks using hybrid

approach of DEA and Regression analysis.

In this paper, we have taken data of 20

Nationalised Indian Banks during financial

year of 2012-13. We have used two input

measure such as interest expended (X1),

operating expenses (Y2) and one output

measure as total income (Y) (total income is

summation of Interest income and other

income). Data has been collected from RBI

website for the financial year 2012-13.

Table 1: Data table for financial year 2012-13

In this paper, we have used the inputorientation

CCR model, input-orientation

BCC model of DEA and Multivariate

Regression analysis model to evaluate

performance measurement of Nationalised

Banks and also comparative study on

parametric and non-parametric techniques.

We have applied Spearman’s rank

correlation test to testing the result obtained

from CCR, BCC and Multivariate

regression.

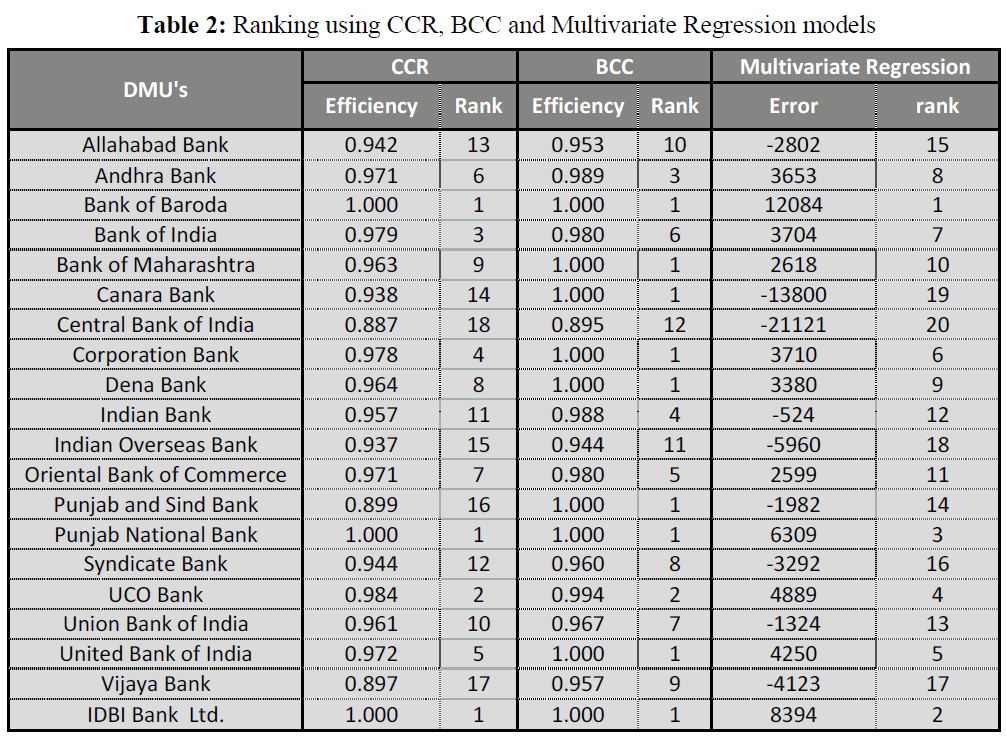

The table 2 shows efficiency and

ranking of each bank using input oriented

CCR model and input oriented BCC model,

last column show ranking obtained through

Multiple regression analysis. The both CCR

and BCC result indicates that Bank of

Baroda, Punjab National Bank and IDBI

Bank Ltd. are efficient frontier and their

ranks are one. Other than these three banks,

efficient frontier banks using BCC model

are Bank of Maharashtra, Canara Bank,

Corporation Bank, Dena Bank, Punjab and

Sind Bank, and United Bank of India. The remaining banks are inefficient and their

scores are less than one. The CCR and BCC

efficiency score of DMUs are calculated by

using R Software and detail result has

shown in CCR & BCC columns of Table 2.

Table 2: Ranking using CCR, BCC and Multivariate Regression models

We have used multivariate

regression model for this data, then the

linear regression equation as:

Y=-5688+1.11X1+1.964X2+

Error of estimation can be computed

by subtracting Y from the actual amount of

the output variable (income) for each DMU.

DMUs are ranked based on descending

error. The results are shown in last two

columns of Table 2. The Multiple regression

result indicates that the Bank of Baroda is

topper bank out of these banks and its rank

is one. The IDBI Bank Ltd and Punjab

National Bank are getting second and third

rank respectively.

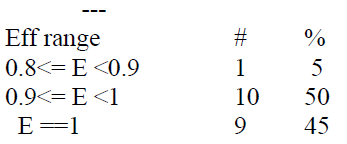

The below descriptive Statistics

summary show overall Nationalised Banks

efficiency obtained through input oriented

Constant Return to Scale model of DEA.

Result indicates that out of 20 banks only

three banks are efficient and having score

one.

Descriptive Statistics Summary of Overall

Banks using CCR model using R software-

>summary(e)

Summary of efficiencies

The technology is crs and input

orientated efficiency

Number of firms with efficiency==1

are 3

Mean efficiency: 0.957

Eff range # %

0.8<= E <0.9 3 15

0.9<= E <1 14 70

E ==1 3 15

Min.1st Qu.Median Mean 3rd Qu. Max.

0.8865 0.9412 0.9632 0.9572 0.9785 1.0000

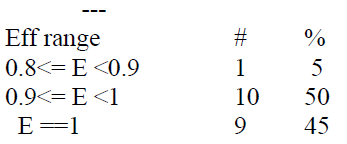

The below descriptive Statistics

summary show overall Nationalised Banks

efficiency obtained through input oriented

Variable Return to Scale model of DEA.

Result indicates that out of 20 banks, nine

banks are efficient (i.e.45% banks

distribution data covered) and having score

one.

Descriptive Statistics Summary of Overall

Banks using BCC model using R software

>summary(e)

Summary of efficiencies

The technology is vrs and input

orientated efficiency

Number of firms with efficiency==1 are 9

Mean efficiency: 0.98

Min.1st Qu.Median Mean 3rd Qu. Max.

0.8952 0.9654 0.9917 0.9803 1.0000 1.0000

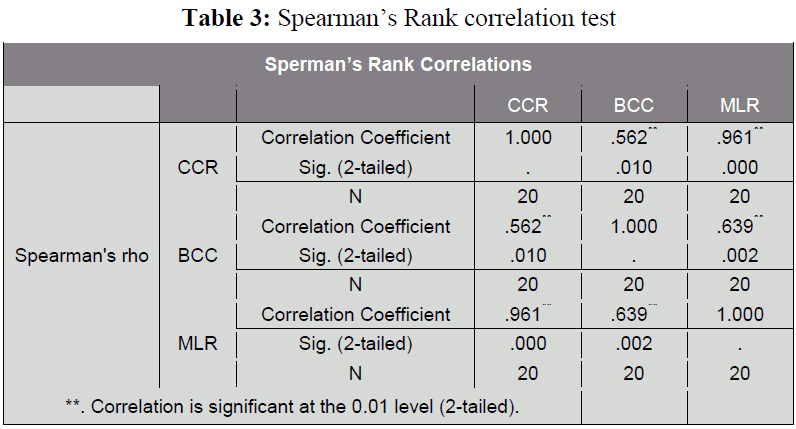

The below Spearman’s rank

correlation test result show, it has applied

for testing comparison between rank

obtained through CCR model, BCC model

and Multiple Regression model. Result

indicates that CCR model and Multivariate

regression model are positively correlated

with each other and its correlation is

0.961.Also result indicates that Multiple

regression and BCC model of DEA are

positively correlated with each other but as

compare to CCR model are less correlated.

See table no. 3

Table 3: Spearman’s Rank correlation test

Conclusion

This paper presents a unique

approach of DEA &Multivariate Regression

Analysis for evaluating Indian banks

performance. We have considered group of

Nationalised Indian Banks (i.e. 20 banks), it

has been analyzed for effectiveness using

DEA & Multivariate Regression Analysis.

We have investigated the performance of

Indian banks by using input orientated CCR,

BCC based DEA model &Multivariate

Regression Analysis (Result has been shown

in table 2). The result shown that the Bank

of Baroda, IDBI banks ltd and Punjab

National Banks has most efficient. We have

tested and verify the relative efficiency

results of CCR model, BCC model and

Multivariate regression model using nonparametric

Spearman rank test. The results

show that there is positively and

significantly correlated between the set of

rankings. This study provides scope for

further research using larger input sample

size to test the robustness of the results.

References

- Charnes, A., Cooper, W.W. and Rhodes, E. (1978), “Measuring the efficiency of decision making units”, European Journal of Operations Research, 2: 429- 444.

- Collier, T., Johnson, A.L. and Ruggiero, J. (2011) ‘Technical efficiency estimation with multiple inputs and multiple outputs using regression analysis’, European Journal of Operational Research, Vol. 208, No. 2, pp.153–160.

- Aigner, D.J., C.A.K. Love11 and P. Schmidt, 1977, Formulation and estimation of stochastic frontier production function models, Journal of Econometrics 6, 21-37.

- Farrel, M.J., 1957, the measurement of productive efficiency, Journal of the Royal Statistical Society A 70, 253-281.

- Cooper, W.W., Seiford, L.M. and Tone, K. (2000) Data envelopment Analysis, Boston: Kluwer.

- Banker, R., Charnes, A., & Cooper, W. (1984). Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management Science, 30, 1078–1092.

- Wang, N. S., Yi, R. H., & Wang, W. (2008). Evaluating the performances of decision making units based on interval efficiencies. Journal of Computational and Applied Mathematics, 216, 328– 343.

- Seiford, L., & Zhu, J. (1999). Profitability and marketability of the top 55 US commercial banks. Management Science, 45, 1270–1288.

- Sengupta, J. (1995). Dynamics of data envelopment analysis: Theory of systems efficiency. Boston, MA: Kluwer Academic Publishers.

- Satye. M, (2003). Efficiency of Banks in developing Economy. The case of India. European Journal of Operational Research. 148(3). 662-671.

- Kumbhakar. S.C. and Sarkar, S. (2004). Deregulation, Ownership and Efficiency in Indian Banking: An application of Stochastic Frontier Analysis. IGIDD working paper. Available at: www.igidr.ac.in/conf/finwrk/workshop.p df.

- Drake, L., & Howcroft, B. (2002). An insight into the size efficiency of a UK bank branch network. Managerial Finance, 28, 24–36.

- Sun, S., & Lu, W. (2005). Evaluating the performance of the Taiwanese hotel industry using a weight slacks-based measure. Asia-Pacific Journal of Operational Research, 22, 487–512.

- Bogetoft, Peter and Lars Otto (2013), Benchmarking with DEA and SFA, R package version 0.23.

- Coelli, T. J., D. S. P. Rao, C. J. O'Donnell and G. E. Battese (2005). An Introduction to Efficiency and Productivity Analysis. Second ed. New York: Springer.

- Kumbhakar, S. C., S. Ghosh and J. T. McGuckin (1991). "A Generalized Production Frontier Approach for Estimating Determinants of Inefficiency in U.S. Dairy Farms." Journal of Business and Economic Statistics 9, 279- 286.

- R.Kiani Mavi et al. (2015), Ranking banks branches using DEA and multivariate regression models. Int. J. Operational Research, 24, 245-261.

- Ataullah, A. and Le, H. (2008) ‘Economic reforms and bank efficiency in developing countries: the case of the Indian banking industry’, Applied Financial Economics, Vol. 16, No. 9, pp.653–663.

- Bhattacharyya and S. Pal. (2013). Financial reforms and technical efficiency in Indian commercial banking: A generalized stochastic frontier analysis. Review of Financial Economics, 22(3):109–117.

- S.Sharma, D. Raina, and S. Singh. (2012) Measurement of technical efficiency and its sources: An experience of Indian banking sector. Journal of Economics and Management, 6: 35–57.

- Premachandra, I.M., Bhabra, G.S. and Sueyoshi, T. (2009) ‘DEA as a tool for bankruptcy assessment: a comparative study with logistic regression technique’, European Journal of Operational Research, Vol. 193, No. 2, pp.412–424.

- E. Thanassoulis. (1993). A Comparison of Regression Analysis and Data Envelopment Analysis as Alternative Methods for Performance Assessments, the Journal of the Operations Research Society, Vol. 44, No. 11, pp. 1129-1144.

- Kooreman P. (1994). Data envelopment analysis and parametric frontier estimation: Complementary tools, Journal of Health Economics, 13: 345- 46.

- Cooper, W.W., Tone, K., 1997. Measures of inefficiency in data envelopment analysis and stochastic frontier estimation. European Journal of Operational Research 99, 72–88.

- Friedman, L., Sinuany-Stern, Z., 1997. Scaling units via the canonical correlation analysis and the data envelopment analysis. European Journal of Operational Research 100 (3), 629– 637.

- Sinuany-Stern, Z., Friedman, L., 1998. Data envelopment analysis and the discriminant analysis of ratios for ranking units. European Journal of Operational Research 111, 470– 478.

- Azadeh, A., Seraj, O., Asadzadeh, S.M. and Saberi, M. (2012). An integrated fuzzy regression-data envelopment analysis algorithm for optimum oil consumption estimation with ambiguous data’, Applied Soft Computing, Vol. 12, No. 8, pp.2614–2630.

- Banker, R., Gadh, V.M. and Gorr, W. (1993). A Monte Carlo comparison of two production frontier estimation methods: corrected ordinary least squares and data envelopment analysis’, European Journal of Operational Research, Vol. 67, No. 3, pp.332–343.

- Coelli, T. and Perelman, S. (1999). A comparison of parametric and nonparametric distance functions: with application to European railways’, European Journal of Operational Research, Vol. 117, No. 2, pp.326–339.

- Collier, T., Johnson, A.L. and Ruggiero, J. (2011). Technical efficiency estimation with multiple inputs and multiple outputs using regression analysis’, European Journal of Operational Research, Vol. 208, No. 2, pp.153–160.

- Ifeagwu E.N., Ogu. C.J. and Alagbu E. (2015). Enhancing the performance of wideband code division multiple access (WCDMA) network using antenna diversity technique, American Journal of Computer Science and Information Technology, Vol.3,No.1, pp.014-25.

- Das, A. and Ghosh, S. (2009). Financial deregulation and profit efficiency: a nonparametric analysis of Indian banks’, Journal of Economics and Business, Vol. 61, No. 6, pp.509–528.

- Premachandra, I.M., Bhabra, G.S. and Sueyoshi, T. (2009). DEA as a tool for bankruptcy assessment: a comparative study with logistic regression technique’, European Journal of Operational Research, Vol. 193, No. 2, pp.412–424.

- Wang, Y.M., Luo, Y. and Lan, Y.X. (2011) ‘Common weights for fully ranking decision making units by regression analysis’, Expert Systems with Applications, Vol. 38, No. 8, pp.9122–9128.

is the ith independent

variable. Therefore

is the ith independent

variable. Therefore  is the

coefficient of

is the

coefficient of  a is constant and

a is constant and is the

estimation error term.

is the

estimation error term.