Keywords

Bank frauds, banking industry, RBI,risk management, use of technology, current

scenario, future challenges.

Introduction

It is universally accepted that for the

smooth functioning of a money market and

economic growth of a country, an efficient

and good banking system is a must. Banking

industry in India has traversed a long-way to

assume its present stature in the21st century.

According to Singh, [1]“The Indian banking

industry is unique and has no parallels in the

banking history of any country in the world.

After independence, the banking sector has

passed through three stages: character-based

lending to ideology-based lending to

competitiveness-based lending.” Similarly,

Kumar and Sriganga [2] stated, “Banking

sector of India accommodates 1175,149

employees, with total of 109,811 branches in

India (and 171 branches abroad), and

manages an aggregate deposit of Rs.

67,504.54 billion and bank credit of Rs.

52,604.59 billion.” Indeed, PSBs have a

75% market share, but the number of funds

by private banks is 5 times of PSBs. The

phenomenal spread of branches, growth and

diversification in business, large-scale

computerization and networking, have collectively increased manifold the

operational risks faced by the banks.

Unfortunately, it is also true banking

industry has to face many types of frauds

and scams. The Reserve Bank of India (RBI)

is the central policy making and nationallevel

regulatory body by keeping an eye

over the entire banking industry.

Recently, Pan [3] stated that “deposits

of Indian banking industry is Rs. 81 trillion

(USD1.30 trillion) in 2014. Banks are using

internet and mobile devices to carry out

transactions and communicate with the

masses.” Moreover, according to KPMG-CII

report [4] “Indian banking sector has potential

to become 5th largest in the world by 2020,

and 3rd largest by 2025.” Besides, Kaveri [5]

remarked that “while the Indian banking

industry has witnessed a rapid growth in

their business and profits, the amount

involved in bank frauds has also been on the

rise. This unhealthy development causes

losses to the banks and badly affects their

credibility.” As KPMG’s ‘India Fraud

Survey 2012’ [6] states, “Despite having a strong regulator, the financial services sector

has emerged as the most susceptible sector

to frauds.” Fraudulent activities cause losses

to banks and their customers, and also

reduce money available for the development

of economy. [7] Shockingly, “the banking

industry in India dubs rising fraud as an

inevitable cost of business” (E&Y).

According to Deloitte India Banking Fraud

Survey Report [8] (Edition II, 2015),

“Common causes of frauds in banking

include diversion & siphoning of funds,

whereas fraudulent documentation and

absence, or overvaluation of collaterals were

the main reasons for fraud in retail banking.”

Thus, in nutshell, “inadequate measures to

prevent banking fraud is the primary reason

for widespread frauds. Technology is like a

double-edged sword [9], which can be used to

perpetuate, detect and prevent frauds.”

However, Gates and Jacob [10] have

pointed out that “the misuse of technology

in the banking includes use of banking

access for over-payments to vendors,

sharing confidential information, and misuse

of technology for unauthorized activities.”

Also, providing services on mobile and

social media platforms, with limited

knowledge of security requirements, poses

lot of threats to customers and banks. [11] Data

analysis software enables auditors and fraud

examiners to analyze an organization’s

business data to gain insight into how well

internal controls are operating and toidentify

transactions that indicate fraudulent activity

or the heightened risk of fraud [12]. Data

analysis can be applied to just about

anywhere in an organization where

electronic transactions are recorded and

stored. As Kumar and Sriganga stated, “By

leveraging power of data analysis

technology, banks can detect fraud very

soon and reduce the impact of losses due to

frauds. Use of new technology can prove to

be very helpful to control the fraud risk in

banks [2].” It is a well-known fact that investigation and prosecution of fraudsters

in India is “very slow, time-consuming

process, thus, the danger of fraud will

always be there. Since banking industry is a

highly-regulated industry, there are also a

number of external compliance requirements

that banks must adhere to in the combat

movement against fraudulent and criminal

activity.

Recently, banking sector business

has become more complex with the

development in the field of information and

communication technology, which has

changed the nature of bank fraud and

fraudulent practices. For example, Berney [13]

observed that customers rely heavily on the

web for their banking business, which leads

to an increase in the number of online

transactions. Similarly, Gates and Jacob,10

and Malphrus [14] have asserted that the

internet provides fraudsters with more

opportunities to attack customers, who are

not physically present on the web to

authenticate transactions. Fraud, however, is

a major component of operational risk. But

if the banker is upright and knows his job

well, the task of the defrauder will become

extremely difficult, if not impossible. This

has thrust enormous responsibilities in terms

of prescribing and maintaining an effective

architecture of internal checks and controls,

and optimum use of innovative

technology. [15] Banks have more technology

and more incentive than ever to combat

fraud in electronic banking services. But

whether they have enough technology and

incentive to protect consumers from the

headaches of a compromised account,

payment card or identity is doubtful.

Meaning and Types of Bank Frauds

Fraud is a worldwide phenomenon

that affects all continents and all sectors of

the economy. As per RBI, fraud can be

“loosely” described as “any behavior by

which one person intends to gain a dishonest advantage over another.” Fraud

encompasses a wide-range of illicit practices

and illegal acts involving intentional

deception or misrepresentation. The Institute

of Internal Auditors’ “International

Professional Practices Framework (IPPF)” [16]

defines fraud as: “Any illegal act

characterized by deceit, concealment, or

violation of trust. These acts are not

dependent upon the threat of violence or

physical force. Frauds are perpetrated by

parties and organizations to obtain money,

property, or services; to avoid payment or

loss of services; or to secure personal or

business advantage.” Fraud impacts

organizations in several areas including

financial, operational, and psychological.

While the monetary loss owing to fraud is

significant, the full impact of fraud on an

organization can bestaggering. In fact, the

losses to reputation, goodwill, and customer

relations can be devastating. As fraud can be

perpetrated by any employee within an

organization or by those from the outside,

therefore, it is important to have an effective

fraud management program in place to

safeguard your organization’s assets and

reputation.

Banks can secure and preserve the

safety, integrity and authenticity of the

transactions by employing multipoint

scrutiny: cryptographic check hurdles. In

addition, banks should rotate the services of

the persons working on sensitive seats, keep

strict vigil of the working, update the

technologies employed periodically, and

engage more than one person in large-value

transactions. Of course, internal auditors can

continue to win the battle against frauds and

scams through the continued application of

fundamentals, such as education,

technological proficiency, and support of

good management practices.Close attention

and vigilance on the part of both banks and

customers is, therefore, the best deterrence.

According to Freddie Mac, [17] “Fraud Mitigation Best Practices” include: (a) Fraud

Risk Management Policies and Procedures:

Put sound and appropriate fraud detection,

prevention, investigation, resolution, and

reporting policies and procedures in place,

and communicate them to employees; (b)

Regulatory Compliance: Ensure appropriate

policies and procedures are in place

pertaining to your company’s obligations

under the RBI Act, as applicable; (c) Ethical

Conduct: Familiarize employees with your

company’s standards for ethical conduct; (d)

New Employee Awareness: Incorporate

fraud awareness in new employee

orientation programs; and (e) Training:

Ensure that employees receive fraud training

appropriate for their roles and levels.

One of the most challenging aspects

in the Indian banking sector is to make

banking transactions free from electronic

crime [18]. Fraud detection in banking is a

critical activity that can span a series of

fraud schemes and fraudulent activity from

bank employees and customers alike. It may

be noted at the outset that all the major

operational areas in banking industry offers

a good opportunity for fraudsters, with

growing fraud and financial malpractices

being reported under deposit, loan, and

inter-branch accounting transactions

(including remittances). Frauds generally

take place in a financial system when

safeguards and procedural controls are

inadequate, or when they are not

scrupulously adhered to, thus, leaving the

system vulnerable to the perpetrators. [19] Most

of the time, it is difficult to detect frauds

well-in-time, and even more difficult to

book the offenders because of intricate and

lengthy legal requirements and processes. In

the fear of damaging the banks reputation,

these kinds of incidence are often not

brought to light. Historical evidence shows

that whether the agency (or individual)

committing the fraud works for the bank or

deals with it, the culprit usually does very careful and detailed planning before he

finally attacks the system at its most

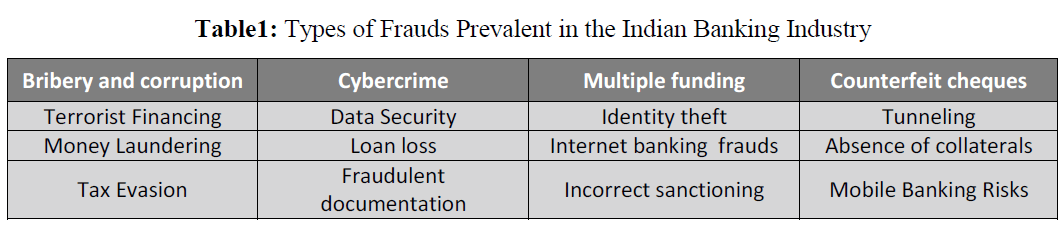

vulnerable point. Table 1 shows some of the

common types of frauds in the Indian

banking sector.

Table 1: Types of Frauds Prevalent in the Indian Banking Industry

In today’s volatile economic

environment, the opportunity and incentive

to commit frauds have both increased.

Instances of as set misappropriation, money

laundering, cyber crime and accounting

fraud are only increasing day-by-day. With

changes in technology, frauds have taken the

shape and modalities of organized crime,

deploying increasingly sophisticated and

innovative methods of perpetration. In the

21st century, as financial transactions

become increasingly technology-driven, new

technology seems to have become the

weapon of choice, when it comes to

fraudsters.

According to the PwC [20] Global

Economic Crime Survey 2014, “cybercrime

was one of the top economic crimes reported

by organizations across the world, including

India.” Regulations and laws governing the

financial services sector in India are

continuously evolving. For any growing

organization, it is critical to keep up with the

changing laws in order to mitigate risks and

stay ahead. Some of the important

regulatory drivers for the financial sector in

India are as follows: (a) Reserve Bank of

India Act, 1934; (b) Securities and

Exchange Board of India Act, 1992; (c)

Companies Act, 2013; (d) Prevention of

Money Laundering Act, 2002; and (e) The

Black Money (Undisclosed Foreign Income

and Assets) and Imposition of Tax Act,

2015. The PwC’s Survey identified that

suspicious transaction reporting, effective

fraud risk management measures, whistle

blowing processes and tip-offs helped

financial services organizations to detect

most frauds.

There is no simple way to squash

fraud, but by implementing the right mix of

technologies and prevention techniques,

treasury executives can greatly reduce their

organization’s risk. As Accenture’s Santoro

puts it, “A solid portfolio of solutions with

multiple layers of protection and controls

can go a long way toward providing the

necessary protection. If you put enough

deadbolts at the door, thieves are going to

give up and look elsewhere.” It is an endless

game of “cat and mouse” between banks and

cyber-criminals. There is a virtual arms race

taking place online between financial

institutions and cyber criminals, who as

soon as the bank deploys a new process or

technology to prevent online fraud, they find

a weakness to exploit. [11,21] In addition,

customers expect to be protected from fraud,

but also want anti-fraud tools to look at them

holistically, assessing the fraud risk of

transactions based on their individual

profiles. Five ways to combat bank frauds

are highlighted below as:

1. Adopt appropriate technologies: An

inclusive mix of strong authentication

systems; analytics software; and bank

services, positive pay and payee verification,

for example, can greatly reduce an

organization’s exposure to fraud. It is

important to have layers of protection.

2. Beef up your internal controls: Sarbanes-

Oxley mandates that companies pay strict

attention to their internal controls. But even

the most thorough Sarbanes-Oxley

compliance effort cannot provide

comprehensive protection against fraud.

Proactive organizations will want to put

additional controls in place, including

rigorous approval procedures and careful

separation of duties. That is especially true

of disbursement processes, such as wire

transfers.

3. Screen job applicants carefully: One of

the biggest security problems company’s

face is fraud perpetrated by trusted insiders.

Key finance functions such as treasury must

conduct background checks on potential

hires, and companies should also consider

drug testing and honesty testing. It is the

first line of defense.

4. Educate your workforce: Employees

need to understand how damaging fraud can

be to the organization. They must be able to

recognize signs of fraudulent activity and

know how to report it. In addition, treasury

employees will need to betrained in the

correct use of the company's fraudprotection

tools and technologies.

5. Prosecute thieves: Many organizations

fire employees who are caught stealing but

avoid prosecuting them for fear of bad

publicity. A zero-tolerance policy goes a

long way toward reducing the risk of illegal

activity. Likewise, managers should

immediately turn over any evidence of

suspected fraud to law enforcement

agencies.

Who is Responsible for Fraud Detection?

While the senior management and

the board of Directors of the Banks are

ultimately responsible for a fraud

management program, internal audit can be

a key player in helping to address fraud. By

providing an evaluation on the potential for

the occurrence of fraud, internal audit can

show an organization how it is prepared for

and is managing these fraud risks. Instead of

relying on reactive measures like

whistleblowers, organizations can and

should take a more hands-on approach to

fraud detection. [11] A fraud detection and

prevention program should include a range

of approaches–from point-in-time to

recurring and, ultimately, continually for

those areas where the risk of fraud warrants.

Based on key risk indicators, point-in-time

(or ad hoc) testing will help identify

transactions to be investigated. If that testing

reveals indicators of fraud, recurring testing

or continuous analysis should be considered.

According to Deloitte India Banking Fraud

Survey Edition II (2015), “Some of the top

reasons for increase in fraud incidents are:

(a) Lack of oversight by line

managers/senior management on deviations

from existing processes, (b) Business

pressures to meet unreasonable targets, (c)

Lack of tools to identify potential red flags,

and (d) Collusion between employees and

external parties.” [8]

In today’s automated world, many

business processes depend on the use of

technology. This allows for people

committing fraud to exploit weaknesses in

security, controls or oversight in business

applications to perpetrate their crimes.

However, the good news is that technology

can also be a means of combating fraud.

Internal audit needs to view technology as a

necessary part of their toolkit that can help

to prevent and detect fraud. Leveraging

technology to implement continuous fraud

prevention programs helps to safeguard

organizations from the risk of fraud and

reduce the time it takes to uncover

fraudulent activity. This helps both to catch

fraud faster and to minimize the impact it

can have on organizations. According to

ACL,11 the analytical techniques, which may

prove very effective in detecting fraud, are

shown below:

• Calculation of statistical parameters to

identify outliers that could indicate fraud

• Classification to find patterns amongst

data elements

• Stratification of numbers to identify

unusual entries

• Digital analysis using Benford’s Law to

identify unexpected occurrences of digits

in naturally occurring data sets.

• Joining different diverse sources to identify matching values where they

should not exist

• Duplicate testing to identify duplicate

transactions such as payments, claims or

expense report items.

• Gap testing to identify missing values in

sequential data where there should be

none.

• Summing of numeric values to identify

control totals that may have been

falsified

• Validating entry dates to identify

suspicious items for postings or data

entry.

As very strongly emphasized by

Bhasin, [22] “In the 21st century, the forensic

accountants are in great demand and

forensic accounting is listed among the top-

20 careers of the future.” Recent accounting

scandals and the resultant outcry for

transparency and honesty in reporting,

therefore, have given rise to two disparate

yet logical outcomes. First, forensic

accounting skills have become very crucial

in untangling the complicated accounting

maneuvers’ that have obfuscated financial

statements. Second, public demand for

change and subsequent regulatory action has

transformed corporate governance (CG)

scenario [23]. Therefore, many senior-level

company officers and directors are under the

ethical and legal scrutiny. In fact, both these

trends have the common goal of addressing

the investors’ concerns about the transparent

financial reporting system. The failure of the

corporate communication structure has also

made the financial community realize that

there is a great need for skilled professionals

that can identify, expose, and prevent

structural weaknesses in three key areas:

poor CG, flawed internal controls, and

fraudulent financial statements. [24] Therefore,

forensic accounting skills are becoming

increasingly relied upon within a corporate

reporting system that emphasizes its accountability and responsibility to

stakeholders.

Magnitude of Frauds in Banks: Indian

Banking Industry Scenario

Different types of frauds caused Rs.

6,600 crores of loss to the Indian economy

in 2011-12, and banks were the most

common victims in swindling cases; insider

enabled fraud accounted for 61% of fraud

cases. However, Soni and Soni [25] concluded

that “cyber fraud in the banking industry has

emerged as a big problem and a cause of

worry for this sector.” Similarly, another

survey conducted by Deloitte [26] shows that

“banks have witnessed a rise in the number

of fraud incidents in the last one year, and

the trend is likely to continue in the near

future.” The Deloitte India Banking Fraud

Survey Report Edition II added, “the

number of frauds in banking sector have

increased by more than 10% over the last

two years. Banks witnessed rise in level of

sophistication with which frauds were

executed.”8 It is universally accepted that

continued prevalence of frauds will have

long-term bad consequences for banks,

customers, investors, government and the

economy in general.

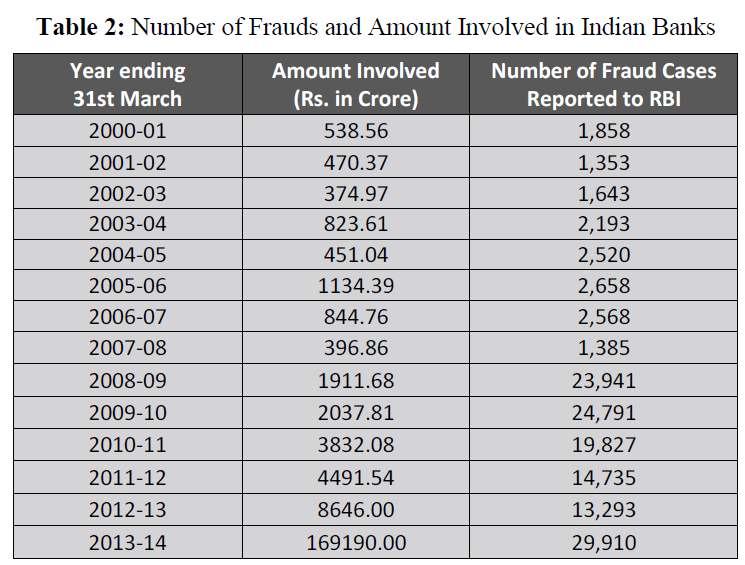

The year-wise details, beginning

from 2000-01 to 2013-14, regarding the

number and amount of frauds reported by

the Indian banking sector to the RBI, are

shown in Table 2. The following broad

generalizations can be made. During the last

six years, from 2000-01 to 2005-06, the

number of fraud cases has shown a

constantly rising trend. For example, in

2000-01 there were 1858 cases of frauds,

which substantially jumped to 2658 fraud

cases in 2005-06. However, in 2006-07 and

2007-08, the number of fraud cases declined

sharply from 2568 to 1385, respectively. In

fact, the amount involved in fraud cases has

also increased very sharply from the lowest

level of Rs. 374.97 crore during 2002-03 to the highest level of Rs. 1134.39 crore during

2005-06. The year 2007-08 was an

exceptional year in which the amount of loss

caused due to fraud declined to Rs. 396.86

crore. In sharp contrast to this, year 2005-06

was also a very significant year for the

banking industry, since this year witnessed

the highest ever fraud loss of Rs. 1134.39

crore. Keeping in view the loss of Rs.

451.04 crore in 2004-05, the loss of Rs.

1134.39 crore in 2005-06, works out to

about 2.5 times the loss of previous year.

Moreover, the scenario of number of frauds

and amount involved has significantly

changed from 2008-09 to 2013-14. For

example, 24,791 cases of frauds were

reported in 2009-10, which showed a

constant trend of decline till 2012-13.

Number of fraud cases reported were 19,827

in 2010-11, which declined to 14,735 cases

in 2011-12, and 13,293 cases in 2012-13 (a

decline of 46.37%), respectively. As against

this, the trend has reversed when we have a

look at the amount of loss suffered by banks

during the same period. For instance, the

amount of loss suffered has increased very

sharply from Rs. 2037.81 crore in 2009-10

to Rs. 8646 crore in 2012-13, an increase of

324.27%. As Pai and Venkatesh [27] (2014)

reported, “As on March 31, 2014 banks

reported total loss of Rs. 169,190 crore from

29,910 cases. In 2012-13, Rs. 13,293 crore

of fraud was detected from 8646 cases.”

During Apr.-Dec. 2014, PSBs suffered

losses of Rs. 11,022 crore from 2100 fraud

cases involving Rs. one lakh or more.

During same period, 46% more amount was

lost due to frauds compared to last full-year.

Table 2: Number of Frauds and Amount Involved in Indian Banks

With the advent of mobile and

internet banking, the number of banking

frauds in the country is on the rise as banks

are losing money to the tune of

approximately Rs. 2,500 crore every year.

While the figure for 2010-11 was Rs. 3,500

crore, for the current financial year (till

September) it is about Rs. 1,800 crore. Further, state-wise list of information on

banking frauds shows Maharashtra

(Mumbai) reporting the highest number of

cases to the RBI. In the last financial year,

banks in the Maharashtra reported 1,179

cases with Rs. 1,141 crore being lost to such

frauds. Maharashtra is followed by Uttar

Pradesh with 385 cases during the same

period.

Review of Literature

Jeffords [28] (1992) examined 910

cases submitted to the “Internal Auditor”

during the nine-year period from 1981-1989

to assess the specific risk factors cited in the

Treadway Commission Report.

Approximately 63 percent of the 910 cases

are classified under the internal control

risks. Similarly, Calderon and Green [29] made

an analysis of 114 actual cases of corporate

fraud published in the “Internal

Auditor”from 1986 to 1990. They found that

limited separation of duties, false

documentation, and inadequate or

nonexistent control account for 60 percent of

the fraud cases. Moreover, the study found

that professional and managerial employees

were involved in 45% of the cases.

Ziegenfuss [30] performed a study to determine

the amount and type of fraud occurring in

state and local government.

Willson [31] examined the causes that

led to the breakdown of ‘Barring’ Bank, in

his case study, “the collapse of Barring

Banks”. The collapse resulted due to the

failures in management, financial and

operational controls of Baring Banks.

However, Bhasin [32] examined the reasons for

check frauds, the magnitude of frauds in

Indian banks, and the manner in which the

expertise of internal auditors can be

integrated in order to detect and prevent

frauds in banks. In addition to considering

the common types of fraud signals, auditors

can take several ‘proactive’ steps to combat

frauds. One important challenge for banks, therefore, is the examination of new

technology applications for control and

security issues. In another study, Bhasin [33]

examined in-depth the corporate accounting

fraud perpetuated by the Satyam

management team in collusion with the

auditor.

As per the survey conducted by

Ganesh and Raghurama [34], about 80

executive from Corporation Bank and

Karnataka Bank Ltd of India, were

requested to rate their subordinates in terms

of development of their skills before and

after they underwent certain commonly

delivered training programs. Responses

revealed that for the 17 skills identified,

there was improvement in the skills

statistically. The paired t-test was applied

individually for the seventeen skills, and all

these skills have shown statistical

significance. Moreover, another study to

investigate the reasons for bank frauds and

implementation of preventive security

controls in Indian banking industry was

performed by Khanna and Arora [35]. The

study “seeks to evaluate the various causes

that are responsible for bank frauds. The

result indicate that lack of training,

overburdened staff, competition, low

compliance level are the main reasons for

bank frauds.”

Mhamane and Lobo [36] in their study

attempted to detect and prevent fraud in case

of internet banking using Hidden Markov

Model algorithm. Chiezy and Onu7

evaluated the impact of fraud and fraudulent

practices on the performance of 24 banks in

Nigeria during 2001-2011. Secondary

sources of data were used for the study. The

relationship between fraud cases and other

variables were estimated using Pearson

product moment correlation and multiple

regression analysis was used. The paper

recommended that banks in Nigeria need to

strengthen their internal control systems and

the regulatory bodies should improve their supervisory role. However, Dzomira [21]

investigated the use of digital analytical

tools and technologies in electronic fraud

and detection used in the Zimbabwe banking

industry. He concluded that banking

institutions should reshape their anti-fraud

strategies to be effective by considering

frauds detection efforts using advanced

analytics and related tools, software and

application to get more efficient oversight.

Similarly, Kumar and Sriganga [2] highlighted

the common insider frauds occurring in

banks and also tried to categorize them into

different types. They focused on different

generic data mining techniques and in

specific, the techniques used for detecting

insider frauds.

The foregoing discussion suggests

that the literature on the bank frauds in

Indian-context is very limited and

inconclusive. Thus, our study builds on the

previous literature of bank frauds in the

Indian banking sector. The scope of the

study has been confined to 21 banks in the

National Capital Region (NCR) of India.

Research Methodology

The present study is both descriptive

and analytical in nature. As part of the

study, in 2013-14 a questionnaire-based

survey was conducted among 345 bank

employees of the National Capital Region

(NCR) area. The questionnaire was

structured into two parts.In fact, the first part

comprised of several questions that

attempted to know their opinions while

working in a bank regarding training

received, attitude towards the procedures

prescribed by RBI, awareness level towards

frauds and their compliance level under the

following six heads: deposit account, loans

and advances, administration of passbook

and check book, drafts section, internal and

inter-branch accounts, and credit-card

section. Moreover, the second part

encompassed the issues about how to integrate technologyin the banking industry

in order to detect and prevent frauds in

Indian banks. It also examined the

technology solutions available and how to

integrate forensic approach to combat bank

frauds in the Indian banking industry.

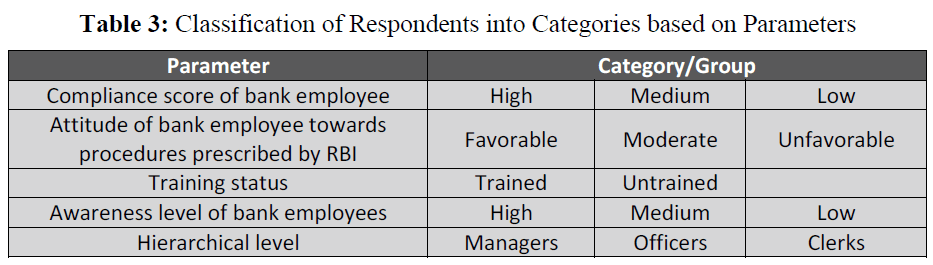

All the respondents were selected

through the random sampling method. There

were 42 public sector banks in the area and

finally, 21 banks were selected. The sampled

employees comprising of Managers,

Officers and Clerks of the branches were

given the questionnaire by personally

visiting them in bank. Out of all the

employees, 296 employees responded, with

an overall response rate of 85%. In all, there

were 57 managers, 130 officers and 109

clerks as respondents and grouped on the

basis of the following parameters, as shown

in Table 3.

Table 3: Classification of Respondents into Categories based on Parameters

Findings and Analysis of Data

The RBI, being the overall central

regulatory agency, has developed many

important guidelines for prevention of bank

frauds, which can help banks to prevent

frauds. In the first part of the questionnaire,

we focused on the compliance level of these

security controls were measured under the

following six heads—internal checks,

deposit accounts, administration of check

books and passbooks, loans and advances,

drafts, internal accounts and inter branch

accounts. The results of this study indicate

that the security control measures are not

fully complied with. As per a study, limited

separation of duties, false documentation,

and inadequate or nonexistent control

account for 60% of the fraud cases. It found

that professional and managerial employees

were involved in 45% of the cases. Thus,

education, training and awareness programs

are informal intervention measures that

should be implemented to prevent frauds.

Undoubtedly, security controls prescribed by RBI, if followed with 100% adherence,

can prevent frauds to a maximum extent.

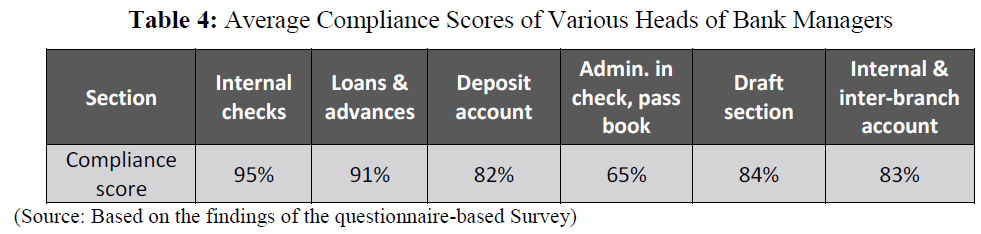

Table 4 depicts the average

compliance score of Bank Managers under

the various heads. The results show that

Bank Managers compliance level is the

lowest (65%) in administration of

check/pass book. In sharp contrast, the

highest (95%) compliance is noticed in

internal checks. The Managers gave second

highest (91%) importance to loans and

advances, and gave almost equal importance

to the draft section (84%), internal and interbranch

account (83%), and deposit account

(82%), respectively. But surprisingly, still

there is lack of 100% compliance related to

security controls under any of the above

listed six bank heads. Thus, it is amply clear

that till now, banks in India are not able to

follow “zero-tolerance” policy. [37]

Table 4: Average Compliance Scores of Various Heads of Bank Managers

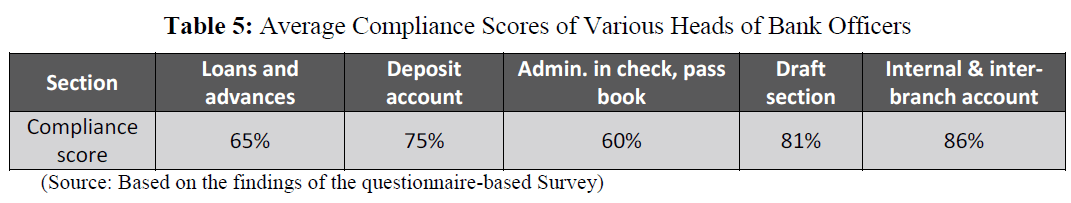

Table 5 provides a snapshot of

average compliance scores of Bank Officers

under the various heads. The compliance

level of Officers is the “highest” in internal

& inter-branch account (86%), followed by

draft section (81%) and deposit account

(75%). Surprisingly, Bank Officers gave the

lowest scores to the following two areas

viz., loans and advances (65%), and

administration in check and pass book

(60%) sections. Keeping in view the Bank

Managers and Officers scores, we can draw

a broad conclusion: nobody likes to perform

the work especially in the administration of

check and pass book section.” Thus, there

appears to be considerable differences in

compliance level of employees of various

banks, most probably, on account of

differences in the organizational culture,

training provided, past experiences and their

mental attitudes to strictly follow the RBI

procedures.

Table 5: Average Compliance Scores of Various Heads of Bank Officers

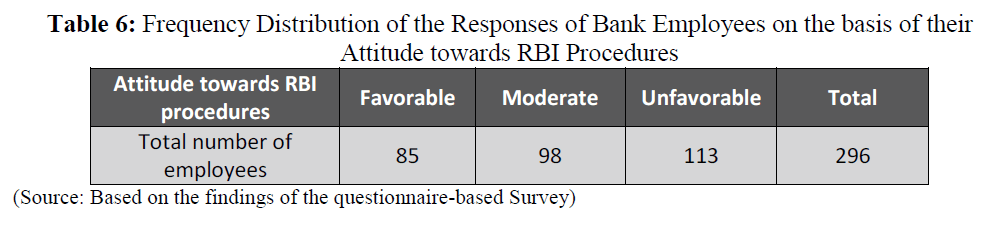

We feel that if the detailed

procedures and/or instructions as prescribed

by the RBI, if fully complied with (both in

letter and spirit), no doubt, it can greatly reduce the incidences of frauds. But the

present study revealed “very low percentage

of respondents display highly-favorable

attitude towards the procedures laid-down

by RBI.” As Table 6 shows, a “very high

proportion of respondent (211/296) believe

that they do not have sufficient staff to carry

out the work meticulously, they are usually

overburdened with work and hence, not able

to follow the procedures strictly. Since this

attitude is based on the perception of bank

employees towards adequacy of staff, it can

be inferred that “if there is an adequate

number of bank staff hopefully the

compliance level will be more.”

Table 6: Frequency Distribution of the Responses of Bank Employees on the basis of their

Attitude towards RBI Procedures

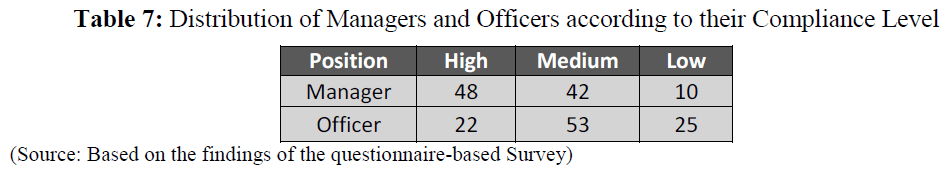

From Table 7, we can conclude that

“the compliance level of the managers

(48%) is higher than that of officers (22%).

This may be due to the fact that managers

are more rigorously trained and their attitude

towards RBI’s procedures is more favorable

than that of officers and clerks. Hence,

Mangers awareness level is high as they

have increased level of responsibility.

Table 7: Distribution of Managers and Officers according to their Compliance Level

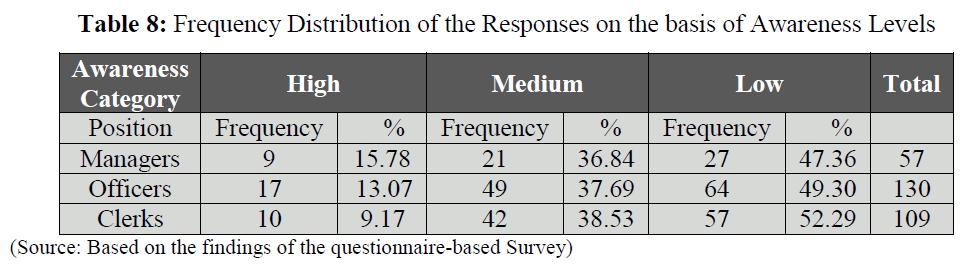

It is amply clear from Table 8 the

awareness level is very low, both on the part

of Clerks and Officers in Banks. For

example, only 9.17% of clerks and 13.07%

of officers belong to “high” category of

awareness level. However, Managers show a

little better awareness level. For example,

around 15.78% of Managers belong to high

category of awareness level. A careful study

of the data contained in the table reveals

shockingly that about 52% of Clerks, 49%

of Officers, and 47% of Managers belong to

“low” category of awareness level. It is very

disappointing to know that the awareness

level of Bank employees about various types

of frauds and losses suffered by the banks

are very low. Hence, with this dismal

scenario, how can we expect from them to

follow detailed procedures and guidelines

issued by the RBI and take pro-active

actions to prevent frauds and mitigate bank

losses?

Table 8: Frequency Distribution of the Responses on the basis of Awareness Levels

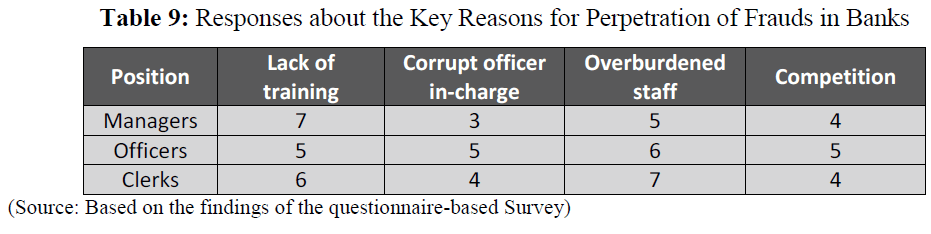

Table 9 depicts the relative

importance (on 10 point score) assigned by

the Bank Managers, Officers and Clerks to

the reasons responsible for the commitment

of bank frauds. Managers gave more weightage

to lack of training (7), and followed by

overburdened staff (5). In sharp contrast to

this, both Officers (6) and Clerks (7) felt that

overburdened staff is the main reason

responsible for bank frauds, which is

followed by lack of training for Officers (5)

and Clerks (6), respectively.

Table 9: Responses about the Key Reasons for Perpetration of Frauds in Banks

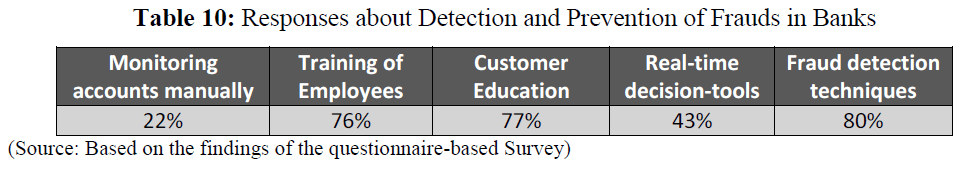

When we asked the bank employees

and managers, 80% indicated that fraud

detection tools and technologies are the most

effective ways of combatting bank frauds.

On the other hand, 43% of the respondents

showed that real-time decision making tools

are effective in preventing fraud, while 22%

respondents showed that monitoring of

accounts is effective, whilst 77% indicated

that customer awareness is most effective of

preventing fraud, and finally, 76% of the

respondents revealed that training of

employee putting emphasis on identification

and response to fraudulent activities is the

most effective way of preventing fraud in

organisations. The response given by Bank

Employees and Bank Managers are shown

in Table 10.

Table 10: Responses about Detection and Prevention of Frauds in Banks

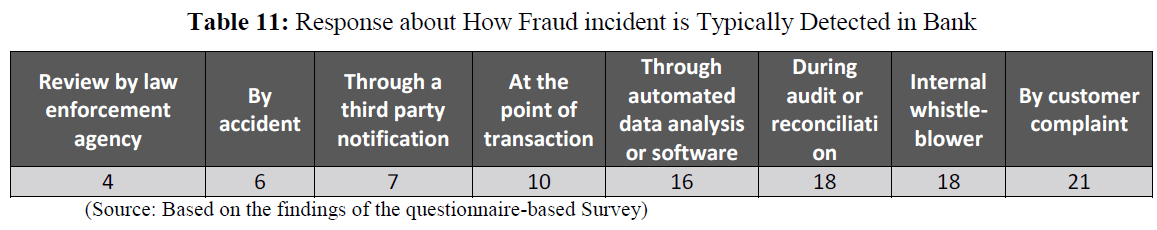

Based on how fraud incident is

typically detected in bank, a large majority

of 21% respondents gave the reason of

complaint by a customer. However, the

second important reasons given by 18% of

respondents were internal whistle-blower

and during audit of accounts or

reconciliation process. Over 16% of

respondents gave the reason “through

automated data analysis or transaction

monitoring software.” Moreover, other

important reasons given by the respondents

were: at the point of transaction (10%),

through a third-party notification (7%), by

accident (6%) and review by a law

enforcement agency (4%), respectively. To conclude, as shown in Table 11,survey

respondents indicated that frauds in their

organizations were most commonly detected

through customer complaints, followed by

an internal or external tip, which is in line

with global trends.

Table 11: Response about How Fraud incident is Typically Detected in Bank

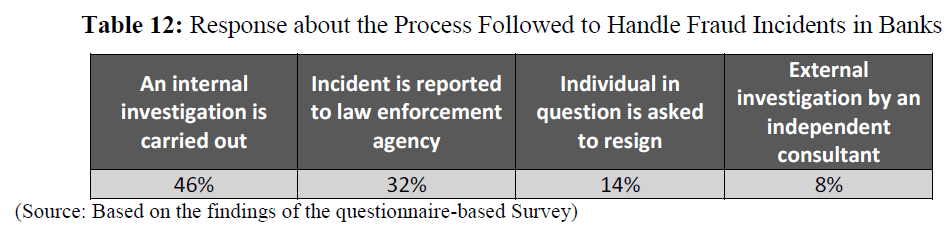

Banks response to fraud is critical as

it has the ability to prevent future

occurrences. Any response to fraud should

be swift and effective so as to percolate the

right message to employees. According to a

2009 Circular issued by RBIstates, “Banks

to investigate frauds of large values with the

help of skilled manpower in order to

effectively take internal punitive action

against the staff in question, along with

external legal prosecution of the fraudsters

and their abettors, if required.” In line with

RBI’s recommendations, the majority of

thesurvey respondents indicated that upon

the detectionof fraud, they carried out

internal investigations, whileothers reported

the incident to a law enforcementagency

(see Table 12). The reasons given by

respondents were: internal investigation is

done (46%), incident reported to legal

agency (32%), and forced to resign (14%). It

is interesting to note that only 8% ofsurvey

respondents indicated using an

independentconsultant to carry out

investigations. Survey respondents

indicated that the top three challenges faced

by banks in preventing fraud were: lack of

customer awareness (23%); integration of

data from various sources (20%); and

inadequate fraud detection tools (18%).

Table 12: Response about the Process Followed to Handle Fraud Incidents in Banks

It is important to understand that

fraud investigation requires specific skill

sets like “forensic accounting and

technology” to collect adequate evidence,

which can be admissible in a court of law. [38]

In the absence of these, banks may not have

the confidence to take legal resource or

action on the fraudster, which could be one

of the reasons why banks may not be

reporting all the cases to law enforcement agencies. While theresponses received in our

survey indicate that banks haveset up a

dedicated fraud investigative cell, it appears

to be hampered by thelack of dedicated

technology tools for investigation. Alittle

over 40% of survey respondents

indicatedthey had not started implementing

dedicated forensic technology tools for

investigation, whereas, 20% of respondents

had partially implemented these tools.Only

20% indicated that they had implemented

forensic technology tools for investigation,

and that thesetools were effective.

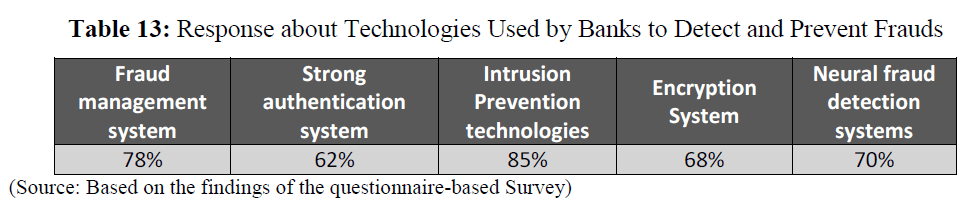

The second part of the questionnaire

focussed very specifically about the use of

technology in banks. Accordingly, we asked

the Bank Employees and Bank Managers

regarding the most effective methodologies

used by them in banks to detect and prevent

frauds. The response given by Bank

Employees and Bank Managers are shown

in Table 13.An overwhelming majority of

85% of the respondents indicated that they

are planning to use in their bank intrusion

prevention technologies. However, 78% of

the respondents expressed the opinion that

fraud management system be planned for

use. However, 68% of the respondents

revealed that they intend to use strong

encryption techniques in future, and 70%

indicated that they plan to apply neural net

fraud detection technologies. As against this,

62% of the respondents plan to use strong

authentication, as on-going fraud prevention

and detection program in future.

Table 13: Response about Technologies Used by Banks to Detect and Prevent Frauds

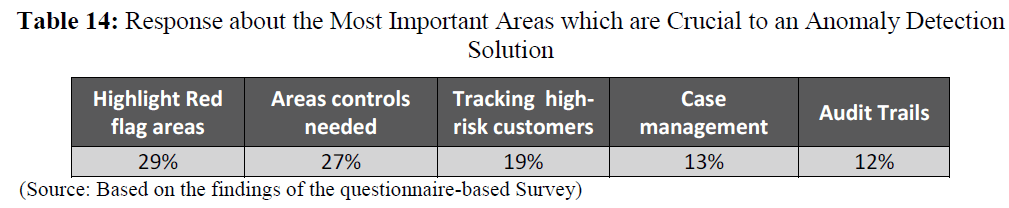

According to the responses received,

53% of the respondents appear to have

implemented a dedicated fraud

detection/analytics solution. However, only

one in every three respondents appears to be

entirely satisfied with it. The following

responses were given by the respondents, in

order of response: ability to highlight redflags

where controls are being circumvented

(29%),ability to identify where enhanced

controls are needed (27%), provide enhanced tracking of high-risk customers

(19%), provide case management abilities

(13%) and provide audit trails (12%),

respectively (see Table 14). Thus, it was

interesting to note that 56% of respondents

sought technology to help them either

highlight red-flag areas (29%), where

controls have been circumvented, or where

controls needed to be enhanced (27%). We

feel this could be because banks have

realized that “deviation from existing

controls by line managers/supervisors is one

of the major causes of fraud in this sector.”

With technology available, which can help

banks detect these deviations in controls, the

internal audit team can also leverage this

solution to undertake forensic based audits,

which could go a long way in enhancing the

efficiency of detecting frauds in time. [39]

Table 14: Response about the Most Important Areas which are Crucial to an Anomaly Detection

Solution

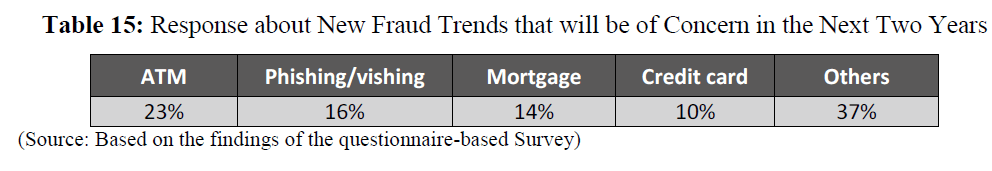

Since banks are increasingly

depending on technology, it is not surprising

to find that cybercrime continues to increase

in volume, frequency and sophistication.

This includes ATM skimming,

phishing/vishing and misuse of credit and

debit cards [40] (Bhasin, 2007). Table 15 shows

that ATM frauds ranked first with 23%,

phishing and vishing attacks with 16%,

mortgage with 114%, credit cards with 10%.

Others (37%), includes options such as

third-party POS skimming, account takeover

fraud, IP theft, money laundering etc.

Additionally, when asked to select the top

three areas which were giving sleepless

nights to bankers, it was no wonder that

internet banking/ATM fraud, E-Banking and

identity fraud were the top culprits.

Interestingly, mortgage portfolio also

appears to be increasingly vulnerable to the

risk of fraud.

Table 15: Response about New Fraud Trends that will be of Concern in the Next Two Years

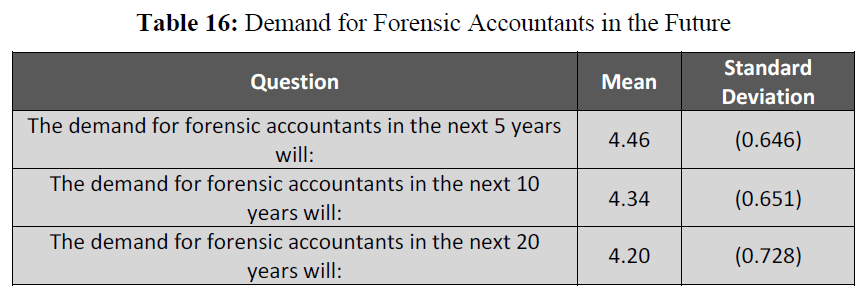

Also, we asked the respondents some

questions about “the demand for FCAs in

the future—next five, ten and twenty years.”

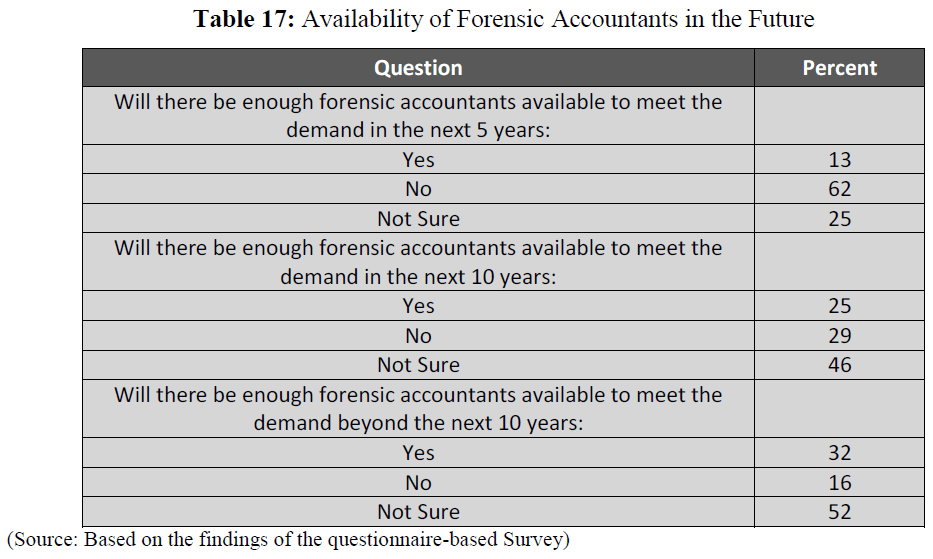

As can be seen from Table 16, the majority

of respondents felt that the demand for

FCAs will increase well into the foreseeable future. In fact, ninety-four percent felt that

the demand for FCAs would increase in the

next 10 years. Respondents were also asked

“if they felt that there will be enough FCAs

available to meet the demand in the next

five, or ten years, and beyond the next 10

years.” As can be seen in Table 17, many

participants were unsure if the supply of

FCAs would be enough to meet the demand

in the future.

Table 16: Demand for Forensic Accountants in the Future

Table 17: Availability of Forensic Accountants in the Future

Recently, the banking industry

around the world has undergone a

tremendous change in the way business is

conducted. As pointed out by Bhasin [41],

“Leading banks are using Data Mining

(DM) tools for customer segmentation and

profitability, credit scoring and approval,

predicting payment default, marketing,

detecting fraudulent transactions, etc.”

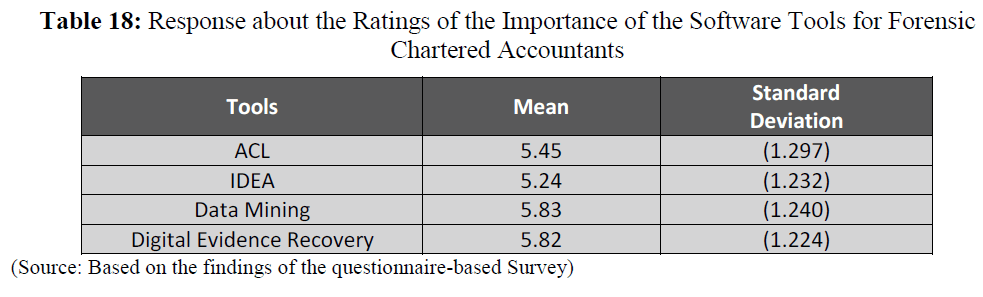

Finally, the sampled respondents were

asked, “In general, do FCAs needs to know

computer-based forensic techniques?”

Eighty-four percent of the respondents

answered in “yes” to this question.

Moreover, we asked the respondents “how

important four different software tools are

for FCAs: ACL, IDEA, Data Mining, and

Digital Evidence Recovery.” The scales

were anchored at each end with the

descriptors “extremely unimportant” and

“extremely important,” respectively. For the

purpose of analysis, the descriptor

“extremely unimportant” was given a weight

of 1, while the descriptor “extremely

important” was given a weight of 7. The

mid-point of the scale “neither” was given a

weight of 4. Table 18 shows the results. The

respondents rated each of these four tools as

important, with data mining being rated as

the most important with a mean score of

5.83.

Table 18: Response about the Ratings of the Importance of the Software Tools for Forensic

Chartered Accountants

Discussion on frauds cannot be

complete without analysis of human

behavior. An employee in a bank is like a

fish in a small ocean. Nobody can determine

when and how much water a fish has consumed. Likewise a corrupt and dishonest

person in a bank can commit frauds with

impunity. [42] Unfortunately, most of the

employees committing frauds get scot free,

with the award of minor penalties, and the

cases pending in courts keep on dragging for

many years. The time taken for cases to be

ascertained as fraud was very high. It took

over 10 years for 45% of the cases and

between 5 to 10 years for 67% of the cases,

creating a great disconnect between the

punishment meted out and the offence. [43]

Recently, the RBI [44] pointed out that

“detection of fraud takes very long-time, and

banks tend to report an account as fraud only

when they exhaust the chances of recovery.

Delays in reporting of frauds further delay

the alerting of other banks about the modus

operandi through caution advices that may

result in similar frauds being perpetrated

elsewhere.” Bhasin [45] concluded “In the

current environment, forensic accountants

are in great demand for their accounting,

auditing, legal, and investigative skills in

order to detect and prevent frauds and scams

in the Indian banking sector.” An analysis of

big cases looked into by the CBI reveals that

bankers sometimes exceed their

discretionary powers, and give loans to

unscrupulous borrowers on fake/forged

documents. More than 7,000 employees of

different PSBs are under the scanner for

their involvement in these cases. As B.

VenkatRamana [46], general manager,

corporate communication, UCO Bank said,

“The most prevalent nature of cheating and

forgery cases relates to forged/fake

documents/diversion of funds by borrowers.

When fraud is proved with employees’

involvement, there is a disciplinary

action/criminal case against the employee.”

According to the General Manager (Risk

Management), Bank of Baroda, the bank

immediately carries out an internal

investigation if a case of fraud is detected.

The incidence is reported to the RBI and a complaint lodged with the local police/state

CID/EOW/CBI depending upon the amount

involved. In case involvement of the

employee is proved, bank takes disciplinary

action, which includes even

termination/dismissal of the employee [47].

There is lack of trained and

experienced bank staff, and tremendous

increase in banking business. By-and-large,

new recruits do not have adequate training

or experience before they are put into a

responsible position. Undoubtedly, training

improves the capabilities of employees by

enhancing their skills, knowledge and

commitment towards their work. [34]

Moreover, bank staff feels they are

overburdened with work. The life has

become fast and the bank staff does not have

enough time to scrutinize documents

thoroughly. Dilution of system and nonadherence

to procedures is also a significant

reason for bank frauds. This shows that a

full-proof system has not been developed

and implemented to familiarize the bank

employees of various types of frauds that

take place in banks every year. “Most banks

try to put in place robust systems and

controls to prevent fraud and forgery—

regrettably crooks and criminals use more

and more sophisticated methods, especially

where online fraud is concerned, to defraud

banks,” said Meera Sanyal, former CEO and

Chairperson of Royal Bank of Scotland in

India [27].

The primary responsibility for

preventing frauds lies with individual banks.

Major cause for perpetration of fraud is

laxity in observance in laid down system

and procedures by supervising staff.

However, the RBI routinely advises

banks about major fraud prone areas and the

safeguards necessary for prevention of

frauds. This is done so that banks can

introduce necessary safeguards by way of

appropriate procedures and internal checks.

With growing usage and dependency on electronic forms of transaction, banks have

employed more secured means and platform

separate from the normal channels of

communication. The authenticity and

integrity of such a platform is ensured

through usage of specific software, which

ensures the validity of the bank’s electronic

documents. [48] To keep the above frauds at

bay, RBI prescribes that bank should

conduct annual review of frauds and apprise

its board regarding the findings; banks

should have proper reporting mechanism in

place to report to the RBI all information

about frauds and the follow-up action taken.

We would like to make the following three

recommendations to the banking industry:

(a) Push top management to implement

policies that encourage moral behavior and

demonstrate an ethical culture. Appoint a

senior person for the anti-fraud group to put

fraud prevention and controls on the bank’s

map; (b) Conduct detailed fraud risk

assessments to help focus management’s

attention on the risks to be addressed. These

should include specific fraud schemes that

could be perpetuated against the bank; and

(c) Prepare an anti-fraud policy and create

appropriate training which clearly defines

fraud and misconduct.

How Technology is Shaping the Fight

Against Bank Frauds?

Technology is like a double-edged

sword. On the one hand, perpetrators are

using it to further fraudulent schemes; on the

other hand, we are making some of our best

progress using the same technology.

Undoubtedly, technology can prove helpful

in fraud detection and prevention in

banks.[49] Unfortunately, the fraud takes on

many forms to be handled with any ‘single’

application or approach. The cat and mouse

game will continue. As technology becomes

more advanced, fraudulent schemes will

become more complex, while more

sophisticated fraud solutions will be developed to combat hackers’ best efforts.

As the landscape of fraud continues to shift,

business leaders must be aware of trends and

predictions that will allow them to

implement internal/external controls and

systems to help reduce the risk of fraud and

keep them from becoming another

statistic.[50] By leveraging the power of data

analysis software, banks can detect fraud

sooner and reduce the negative impact of

significant losses owing to fraud.

Neural Networks have been

extensively put to use in the are as of

banking, finance and insurance. Usually

such applications of neural networks

systems involve knowing about the previous

cases of fraud, to make systems learn the

various trends. Fraud cases are statistically

analysed to derive out relationships among

input data and values for certainkey

parameters in order to understand the

various patterns of fraud. This knowledge of

fraud trends is then iterativelytaught to feedforward

neural networks, which can

successfully identify similar fraud cases

occurring in the future. [51] In the realm of

fraud detection, the ability to

revealrelationships, transactions, locations

and patternscan make the difference

between uncovering a fraudscheme at an

early stage as opposed to having it grow into

a major incident. From moneylaunderingschemes

to anti-corruption laws,

from manipulatingfinancial statements by

reporting fictitious revenues toinappropriate

sanctioning; forensic analytical tools

canhelp explore data and quickly identify

errors, irregularities and suspicious

transactions embedded within your business,

thereby providing clarity to concerns raised

by managers and employees [52].

Whether it is financial transactions,

customer experience, marketing of new

products or channel distribution, technology

has become the biggest driver of change in

the banking sector. Most banks are, therefore, insisting on cashless and paperless

transactions. The substantially larger

proportion of technology related frauds in

the Indian banking sector by number is only

expected as there has been a remarkable

shift in the service delivery model with

greater technology integration in the

banking industry. Even though the incidence

of cyber frauds is extremely high, the actual

amount involved is generally very low. The

new technologies adopted by banks are

making them increasingly vulnerable to

various risks, such as, phishing, identity

theft, cards kimming, vishing (voicemail),

SMSishing (text messages), Whaling

(targeted phising on high net worth

individuals),viruses and Trojans, spyware

and adware, social engineering. [53,56]

Changing technology and rapid flow of

information have placed the customer at the

center. It is critical for every bank to

understand customer needs and expectations

and offer customized services.

While some of the risks in the

banking sector have always been there, they

keep on changing with the constantly

evolving technology standards and

regulatory framework. Part of the challenge

is that the types of financial fraud and

characteristics of fraudsters have changed in

recent years. For instance, check fraud is in

decline while electronic fraud is on the rise,

and the latter tends to be perpetrated by

more sophisticated criminals. Cheque fraud

has been around the globe since the ancient

time, but the pace of changing schemes has

been very slow for banks to react with very

good procedures—many of them still

‘manual’. According to Bhasin [54], “Some of

the technological innovations, which may be

already in use in some banks are: (a) Twodimensional

Bar Codes, (b) Data Glyphs, (c)

Biometrics, (d) Cheque Image Processing,

(e) Data Mining (f) Data Analytics, etc.”

Given this complicated fraud prevention

picture, banks will need to figure out their own patterns of exposure and deploy tools

with the best fit. Banks have more

technology and more incentive than ever to

combat fraud in electronic banking services.

But whether they have enough technology

and incentive to protect consumers from the

headaches of a compromised account,

payment card or identity is doubtful. Threats

are escalating more quickly than what

banks, or even just other businesses in

general, can deploy in terms of defenses

against those threats. [55]

There is no “one silver bullet” to

stop all frauds forever. Rather, the pace of

new threats is not going to slow down and

nobody (no bank, no retailer and no

consumer) is ever 100%secured. What is

needed instead is a combination of checks

from a layered approach that banks will

have to adopt and consumers will have to

accept if they want to utilize electronic

banking services. That suggests consumers

should expect to see, and might want to

welcome, an ongoing stream of new

solutions that banks will employ to stay a

step ahead of electronic banking fraudsters.

It is most unfortunate that the current system

of usernames and passwords, with which

consumers are familiar, is basically broken.

Consequently, banks also have begun to

deploy an array of other technologies, some

of which are so exotic and sophisticated they

might seem like science fiction [56].Here, is a

summary of some of the technology that is

on tap:

• Device fingerprinting tracks a series of

identifiable hardware and software

attributes to recognize a user’s (or

fraudster’s) device.

• Behavioral analytics monitor navigation

techniques and other aspects of a user’s

online behavior to search for anomalies

or suspicious activity.

• Malware detection searches for

potentially fraudulent changes to a user’s Web browser to assess whether it's been

compromised.

• Knowledge-based authentication presents a series of static or dynamic and

supposedly secret questions to establish

a user’s identity.

• Password tokens give a user a one-timeonly

password that must be entered

before it expires.

• Out-of-band authentication challenges

a user to access a one-time-only

password or code that is sent to another

device, such as a mobile phone or land

line.

• Transaction signing requires a user to

digitally sign each transaction.

• Endpoint protection requires a user to

download a one-time-only, secure

browser to access a website.

• Voice printing records attributes of a

caller’s speech over time and matches

those attributes against subsequent calls.

Voice printing is an example of

biometrics, which use unique physical

traits, or characteristics to identify

individuals.

However, as technology advances,

we are seeing a distinct proliferation of more

complex fraud schemes. At the same time,

we are seeing more breakthroughs in the use

of technology to detect fraud. Strategies that

we have used in just the past few years will

become completely outdated, as a fresh set

of tactics will debut.50 To minimize the

potential damage of fraud, companies need

to invest not just in more advanced

technology but in people and policies for

detecting attacks as quickly as possible.

While the networks are just too large to

prevent every attack from occurring,

detection is crucial. Most companies do not

have adequate protocols and staff in place to

deal with incidents of fraud. While advanced

technology serves as a great tool to combat

fraud, the issue should be viewed as more

than just an IT problem and looked at as a business problem. Remember, the cost of

trying to prevent fraud is far less expensive

to a business than the cost of fraud

committed on a business. [51]

Global Trends in Fraud Prevention and

Detection

Technology can play a major part in

combatting new age frauds, the E&Y Fraud

Survey [57] noted and added that a “proactive

Forensic Data Analysis” can help

governments, regulatory bodies and

corporate to counter the increasingly

complex nature of frauds. While it is not

possible for banks to operate in a zero fraud

environment, proactive steps such as

conducting risk assessments of procedures

and policies can help them hedge their risk

of contingent losses due to fraud. Some

techniques such as data visualization have

proved to be effective. Fuzzy logic is

another technique, which can be used on the

data records of a company. These clubbed

with a social network analysis, can indicate

possible threat of collusion. Progressive

reviews of unstructured data can help banks

analyze the sentiments, tones and elements

described in the fraud triangle (incentive,

pressure and rationalization). This, together

with unsupervised pattern recognition, can

proactively help them to put in place fraud

parameters. A careful study of the latest

fraud cases in India suggests: (a) banks the

most vulnerable, (b) difficult to detect

collusion and (c) need for investors to be

vigilant. Banks are enhancing their

processes, controls and fraud risk

management frameworks to minimize the

opportunities for fraud, as well as, reduce

the time taken in their detection. Many

banks are implementing their fraud control

and reporting frameworks to generate

information in a way that the level of fraud

identified, prevented and actual losses

incurred are identified. This approach has

enabled the benefits of skilled resources and automated tools to be quantified more

precisely.

Regulators and investigative

agencies are also trying to gear up for the

changed environment. The Central Bureau

of Investigation (CBI) announced that it is

developing a “Bank Case Information

System (BCIS)” to curb banking frauds.

This database contains the names of accused

persons, borrowers and public servants

compiled from the past records [58]. Moreover,

the RBI [59] has released “a new framework to

check loan frauds by way of early warning

signals for banks and red flagging of

accounts where defaulters shall have no

access to further banking finance.” It also

has plans to set up a “Central Fraud

Registry” that can be accessed by all Indian

banks. In addition, the CBI and Central

Economic Intelligence Bureau (CEIB) will

share their databases with banks. The SEBI

is in the process of getting its existing

business intelligence gathering software,

which is used for detecting fraudulent

activities in capital markets, upgraded.

Whilst the legal environment and regulators

have pushed the financial sector in the right

direction, individual institutions are also

taking the lead in protecting their earnings

and reputation. Some of the top trends

include:

• Automated Analysis Tools: Today, the

industry is increasingly aware of the

need for automated analysis tools that

identify and report fraud attempts in a

timely manner. Solution providers are

providing real-time transaction

screening, third-party screening as well

as compliance solutions.

• Sector-Oriented Benchmarking Solutions: Solutions aimed at assessing

the fraud vulnerability of financial

institutions are now available. They help

in formulating a targeted and costeffective

action plan against fraud risks.

• Data Visualization Tools: These are

being used to provide a visual

representation of complex data patterns

and outliers to translate

multidimensional data into meaningful

pictures or graphics.

• Behavioral Analytics: This is helping

businesses identify enemies disguised as

customers. The data analytics

implemented by the institutions to

understand customer behavior,

preferences, etc. are also helping in the

detection of fraudulent activity either in

real-time or post mortem.

• Deep Learning: Internet payment

companies providing alternatives to

traditional money transfer methods are

using deep learning, a new approach to

machine learning and artificial

intelligence that is good at identifying

complex patterns and characteristics of

cybercrime and online fraud.

• The Internal Audit Function: This

function is being altered to include fraud

risk management in its scope. The

changed technological landscape

requires the old ways of internal auditing

to give way to new, technologically

equipped audit functions. Annual audit

planning may no longer be fully

effective and flexible audit plans are the

need of the hour, as fraud risk

assessments require extensive use of

forensic and data analytics solutions.

Effective background checks of

employees and associates are recommended.

It is difficult but also necessary to integrate

data from various sources to be able to

derive the benefits of analytics techniques.

Banks do face challenges in maintaining the

efficiency of anti-fraud security controls at

an enterprise-wide level. Challenges arise

while integrating channels or within

applications and tools (integrating online

and ATM transactions, retail banking and

corporate banking or integrating subsidiary banks where different information systems

are used). The tone at the top is critical in

the fight against fraud. Lack of customer

and/or staff awareness can result in failure

of even the best of technology solutions. It

takes a concerted effort to be able to build,

maintain and sustain an effective fraud risk

management program. Banks need to build

awareness around the latest technological

and procedural vulnerabilities and fraud

schemes, to be able to remain one-step

ahead of the fraudsters.

In addition, incident management

procedures need to be well-defined and

comprehensive, in order to ensure that

incidents of fraud are managed without

exposing the organization to any legal or

reputational risks. Forensic tools can be used

to navigate IT systems for evidence of

malfeasance such as information deletion,

policy violations and unauthorized access.

These tools can help the company legal

counsels to prepare for a suit to be filed

against the fraudster. Apart from internal

controls, banks need to also educate the

customers. Since the manoeuvres used by

cyber-criminals to target sensitive financial

data are sophisticated and constantly

changing, financial institutions must look at

existing security controls with a new

approach and risk appetite. The three lines

of defense can only be strengthened by

technology, not replaced by it.

Customers love online banking for

its convenience, while banks benefit from

lower costs and a greater reach than a

physical branch network provides. Since

banking fraudsare going to ultimately affect

customer relationship quality and customer

loyalty, fraud prevention and its effective

communication is very important. [60] In order

to ensure that both parties continue to

benefit from online banking, it must remain

a safe and secure channel that allows

legitimate customers access as needed, while

simultaneously blocking entrance to cybercriminals. Cybercriminals will

continue to target online banking for as long

as it is worth their effort to do so. Each

instance of online fraud helps additional

investment by cybercriminals in the people

and technology they need to overcome

bank’s defenses. Although, there is not a

“one-size-fits-all” portfolio of fraud tools

and tactics that is applicable to all banks, the

following approaches do exist that can prove

highly effective in preventing online frauds:

(a) multi-factor authentication, (b) geolocation,

(c) device recognition, (d)

transaction monitoring, (e) navigation

controls, (f) cross-channel, and (g) entitylink

analysis. Educating the customer on

how to help prevent online banking fraud is

just one element of a bank’s fraud defenses.

Deploying advanced technology that can

quickly adapt to changes in the

cybercriminal’s modus operandi is essential

to protecting the online channel. Customer

must have confidence in the security of a

bank’s online platform. There is no end in

sight, but banks must stay committed to

winning each battle they fight to prevent

online fraud. [61] To help prevent and detect

financial crime, banks need both an

integrated (and timely) data set and the

ability to bring sophisticated analytics to

bear on the data to generate useful insights.

Thus, we see the following three major

elements for banks that comprise this

capability: (a) enhanced data quality, (b)

analytics to transform data into information,

and information into insight, and (c)

application of data visualization techniques.

Conclusion

While the banking industry in India

has witnessed a steady growth in its total

business and profits, the amount involved in

bank frauds has also been on the rise. This

unhealthy development in the banking sector

produces not only losses to the banks but

also affects their credibility adversely. [5] According to Klein [62], “The business firms

lose 5% of revenue each year to fraud.

When applied to the 2013 estimated gross

world product, this revenue loss translates to

a global figure of nearly USD3.7 trillion.”

Accordingly, the Government of India has

expressed serious concern over the sharp

rise in cases of fraud and corruption in the

Indian banking sector. Recently, the RBI

chief Mr. Rajan has written to the PMO

seeking concerted action in the country’s 10

biggest bank frauds allegedly involving

prominent real-estate, media and diamond

firms that are being probed by the CBI. [63]

Moreover, fraud and fraudulent activities

inflict severe financial difficulties on banks

and their customers; they also reduce the

amount of money available for the

development of the economy.[7] Many banks

and companies that have been victims of

frauds are reluctant to share and publicize

the facts of the fraud cases due to fear of

‘adverse’ impact on their reputation. [64]

Inadequate measure to prevent

banking fraud is the primary reason for

widespread frauds. So, what should banks

do to safeguard the interests of its

customers? According to Chakrabarty [65],

Deputy Governor of the RBI, “Banks should

strengthen their reporting system, quickly

report fraud cases, and fix staff

accountability. There is urgent need for

sharing practices of fraudsters and methods

used by such criminals.” As Siddique and

Rehman [66] stated, “The only promising step

is to create awareness among people about

their rights and duties, and make application

of laws more stringent to check crimes.”

Banks should ensure that the reporting

system is suitably streamlined so that frauds

are reported without any delay and fix staff

accountability. Banks must provide

sufficient focus on the “Fraud Prevention

and Management Function” to enable

effective investigation of fraud cases.

The fraud risk management, fraud monitoring and fraud investigation function

must be owned by the bank’s CEO, its Audit

Committee of the Board and the Special

Committee of the Board, at least in respect

of large value frauds. [67] Banks can also frame

internal policy for fraud risk management

and fraud investigation function, based on

the governance standards relating to the

ownership of the function and accountability

for malfunctioning of the fraud risk

management process in their banks.

According to E&Y [57] ‘India Fraud

Indicator’ “Since it is impossible for banks

to work in a fraud-free environment, banks

should conduct risk assessment of policies

and hedge the risk of likely losses due to

fraud.” Expressing concern over zooming up

of the corporate fraud in the last 15 years,

Mr. RanjitSinha (CBI Director), said at an

ASSOCHAM [68] event, “Rising number of

frauds in Indian banks are taking place due

to collective failure of regulatory oversight

system comprising of external auditors,

audit committee, internal audit system,

board of directors, independent directors,

shareholders, etc. All regulatory and

investigative agencies must work in close

cooperation and share their inputs and

databases with each other in order to prevent

frauds.” Although banks cannot be 100%

secure against unknown threats, a certain

level of preparedness can help to face with

confidence fraud risks. Recently, the RBI

has “established Central Fraud Registry [59] by

sharing information about unscrupulous

borrowers at the time loans are sanctioned

by cross-checking their credentials, and

thus, helping banks to control their bad

loans. The CBI and Central Economic

Intelligence Bureau will also share their

databases with banks.” The regulators also

stressed on prevention of fraud through

improved market intelligence. Now, we are

hopeful that with the help of new initiatives,

banking industry would be able to minimize the fraud losses, gain customer trust and

improve their reputation.

The top three fraud risks that are